As long as there are people, they will need places to live and do business, making property management a safe business to go into. Some of the wealthiest people in the world earned the bulk of their income through property investment. The best thing about it is that you don’t have to be a business guru to get started as a property investor, but you do need capital.

One of the biggest problems facing every fledgling entrepreneur is where the funds will come from. Getting a loan for an investment property is difficult, but these tips will help.

Get Your Credit Score Up

Your ability to get a property loan depends greatly on the strength of the housing market, but your credit is the most key factor. Lenders want to see that you have a consistent willingness and ability to pay your debts when they’re due. If you’ve only got mediocre—or even bad—credit, then you need to think twice about trying to get an investment property loan right now. A low credit score will only result in you being turned down or receiving a higher interest rate.

Before you attempt to get an investment property loan, get a credit report. Seeing what negative items are affecting your credit score will allow you to come up with a plan to raise it. Your first priority needs to be making good on any delinquent accounts, and then you need to keep any other accounts from closing. Delinquent accounts are red flags to lenders, and they destroy your credit.

Shop Around

Getting an investment property loan is much different from getting a loan for a primary residence. You’re not just looking for lenders now—you’re looking for people to invest with you. You just have to find the right partner to go into this business venture with.

You need to apply to as many lenders as possible to increase your chances of landing a lender—or investor. It’s simple mathematics—casting a wider net brings in more fish. Applying for multiple loans also increases the likelihood that you’ll get low rates for investment property loans.

To become a successful business person, you’re going to have to learn that you’re going to hear “no” as well as have to say it. Don’t let that two-letter word deter you when you’re looking for real estate loans. If you keep knocking, then those nos will eventually become yesses.

Save Up

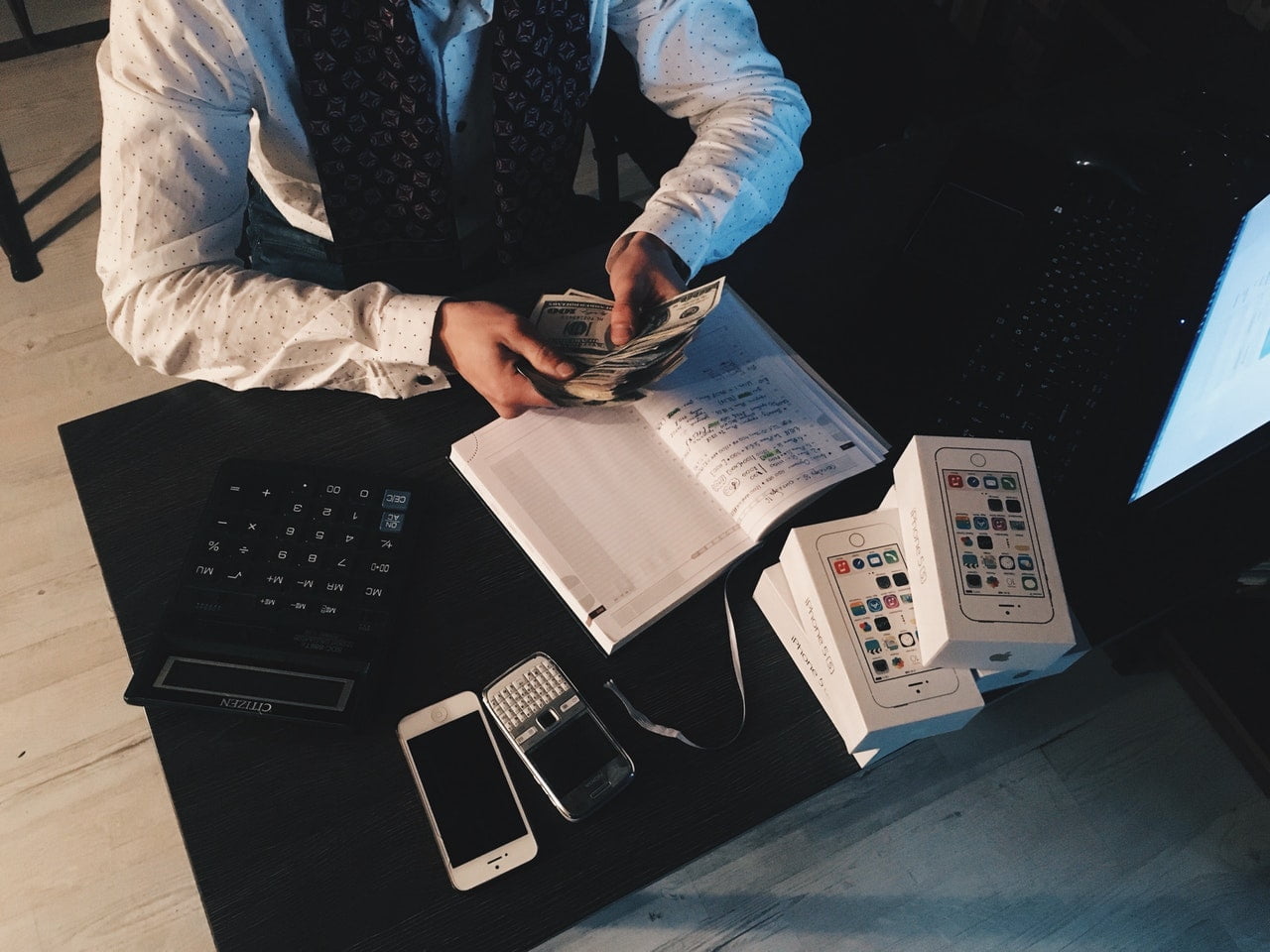

Getting a loan for your investment property will save you a bundle in out-of-pocket expenses, but you still need to have money in your pockets. Lenders want to see that you know how to manage money, and you also have to make a down payment on the property.

Securing a loan for an investment property is all about showing the lender that you can be a responsible borrower. Save your money—as much as is possible—to show lenders that you’re serious about your business and financially prepared for any rainy-day scenarios.

In addition, your savings will improve your ability to pay off the loan. Be prepared for the possibility that lenders won’t accept future rental income as evidence of your ability to pay off your loan. In such a case, you need to be able to show them that you can afford the mortgage for your primary residence and the investment property with your current income.

Look The Part

Even though lenders will have enough material to decipher to determine your trustworthiness for an investment property loan, your presentation matters. As the old saying goes, “First impressions are lasting impressions.”

Whenever you meet with lenders, you want to look the part of a real estate mogul. That doesn’t mean you have to go purchase a $3,000 suit and gold cuff links, but you need to represent your brand. Show lenders that you’re all business, from custom folders for your paperwork to detailed infographics that show your expected rental income.

Getting a loan for your rental property won’t be easy, but it’s achievable. Fix your credit, save your coins, and be serious about your business, and the lenders will notice.